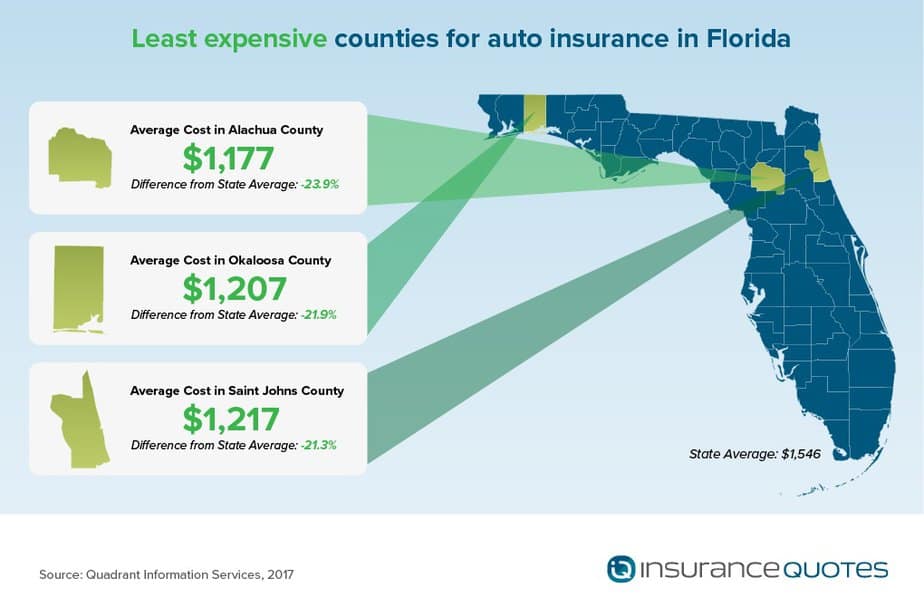

"Companies make use of ranking areas, yet a region in a research study such as this can show higher premiums because of ordinary loss prices because location across insurance coverage firms - auto. We have actually not performed a thorough testimonial of the detail of the method made use of in this research, however it is not unexpected that loss prices, danger, and also prices differ in various parts of the state." Tipping back further as well as checking out the price of vehicle insurance coverage by region, a likewise varied landscape emerges.

Counties with the least expensive insurance policy prices often tend to be in the state's most rural, sparsely booming areas, while those counties with the highest prices tend to be one of the most densely populated in the state (cheaper car insurance). Miami-Dade Region is the largest in the state, with a population of 2.

"When you think about that Miami-Dade County is so highly booming, with a whole lot of four-lane interstate highways running with it and also motorists taking a trip at high rates, you are normally going to have even more mishaps than in various other parts of the state," Mc, Christian states. "As well as that increased chance of accidents is one of the reasons those motorists pay more for insurance coverage." Mc, Christian additionally aims out that Florida's most populated cities and also areas do not have comprehensive public transport choices seen in various other East Coast metropolitan areas. insurance.

"So as to get about in Florida you much more or less need to do it in an auto." As for whether customers need to be concerned about the disparity of premium prices throughout the state, James claims no. "Ninety-nine percent of what drivers pay for automobile insurance policy is based upon the statistical job of actuaries, and there's no means to stay clear of the relationship between populace density as well as the increased probability of accidents, burglary, and also fraud," James says.

"Insurance policy whether it's automobile or house represents the risk of where you live, as well as it's valid that the dangers are different in various parts of the state," Mc, Christian states. "Florida is not just one uniform entity." SIGHT PRESS LAUNCH.

The What Determines Car Insurance Rates? - Florida Online ... PDFs

The fines for driving without car insurance policy in Florida include a reinstatement cost of $150 up to $500 for subsequent offenses, as well as the driver has to offer evidence of current Florida insurance., Florida's cars and truck insurance policy regulations need all vehicle drivers to present proof of obligation insurance when they register their car.

Nevertheless, Florida additionally has a texting while driving restriction for all vehicle drivers. Florida SR-22 Insurance Coverage Papers Florida SR-22 insurance coverage papers are required for chauffeurs that have actually been founded guilty of driving without automobile insurance coverage. An SR-22 form may need to be submitted for 3 years with the DHSMV, showing proof of economic responsibility.

Your insurance company can digitally submit SR-22 insurance coverage files to the state of Florida for drivers that are called for to maintain and also show legitimate automobile obligation insurance policy. vehicle.

The car insurance business also has rideshare insurance coverage for insurance holders that drive for Uber, Lyft and also other solutions (auto insurance). As Florida's tourism-heavy cities are several of one of the most prominent in the country for rideshare solutions, this optional insurance coverage might be beneficial for lots of vehicle drivers. Allstate also has a safe driving program called Drivewise.

State Ranch has a secure driving program for vehicle drivers under the age of 25 called Steer Clear. The program consists of training courses, mentoring as well as practice driving hours to aid trainee vehicle drivers earn automobile costs price cuts. Motorists can also save by making use of the Drive Safe & Save, TM program. This usage-based program displays driving actions and benefits consumers for secure driving with price cuts up to 30%.

Some Known Details About Car Insurance Rates In Southwest Florida Are Increasing ...

As we stated, the state of Florida is not known for its secure driving problems. The probability of getting involved in an auto crash is a lot greater in Florida than in various other states. Due to this, USAA's accident forgiveness strategy may be attractive to many chauffeurs in the Sunlight State. If you continue to be accident-free for five years, your next at-fault accident will not trigger your vehicle insurance coverage costs to increase - insurance affordable.

If you're a risky chauffeur such as a chauffeur under the age of 25, a senior chauffeur or somebody with a DUI/DWI on your driving record Progressive is one the few insurers that can still provide you low auto insurance coverage rates (cheaper car insurance). Taking into consideration almost 30% of Florida's populace is either in between the ages of 16 and also 24 or over the age of 65, Progressive might be the ideal alternative for numerous Floridians.

AM Finest provided Progressive an A+ monetary rating.

Florida is just one of one of the most lovely states in America with wonderful, pleasant climate, numerous miles of open roads and whole lots of shoreline to check out. car. Prior to jumping into an automobile and also heading to those white sand coastlines, make certain you're obtaining the finest offer on your auto insurance policy by selecting one of the 5 finest cars and truck insurance firms in Florida.

It pays to do your study and also compare as several prices as possible using our comparison tool below. It's likewise essential to choose an auto insurance provider that provides to your specific requirements, whether you're an older chauffeur, a homeowner or have an inadequate driving background you're trying to improve.

The smart Trick of This Is The Most Expensive State To Be A New Driver - The ... That Nobody is Talking About

In the most current 2020 J.D. Power Automobile Insurance Policy Research, Allstate claimed the leading spot for highest possible general consumer contentment in Florida. laws. It was carefully complied with by Esurance on the list, which is unsurprising since Allstate got Esurance in 2011. This shows that throughout all brand names, Allstate ranks extremely in Florida for customer support fulfillment.

People go with difficult times as well as are occasionally incapable to pay their insurance coverage costs. Work losses take place, which can bring about repossession and bad credit rating. People can likewise turn those scenarios around and obtain a new lease on life. The General is an automobile insurance provider that understands that.

Some of the tools and research study we took into consideration include: We looked into the average annual premiums of cars and truck insurance policy companies in Florida as well as which vehicle insurance provider had the most effective monetary stamina. Poor economic health and wellness might lead to issues when paying insurance claims in the future, so it's a vital sign to consider when picking a cars and truck insurance provider.

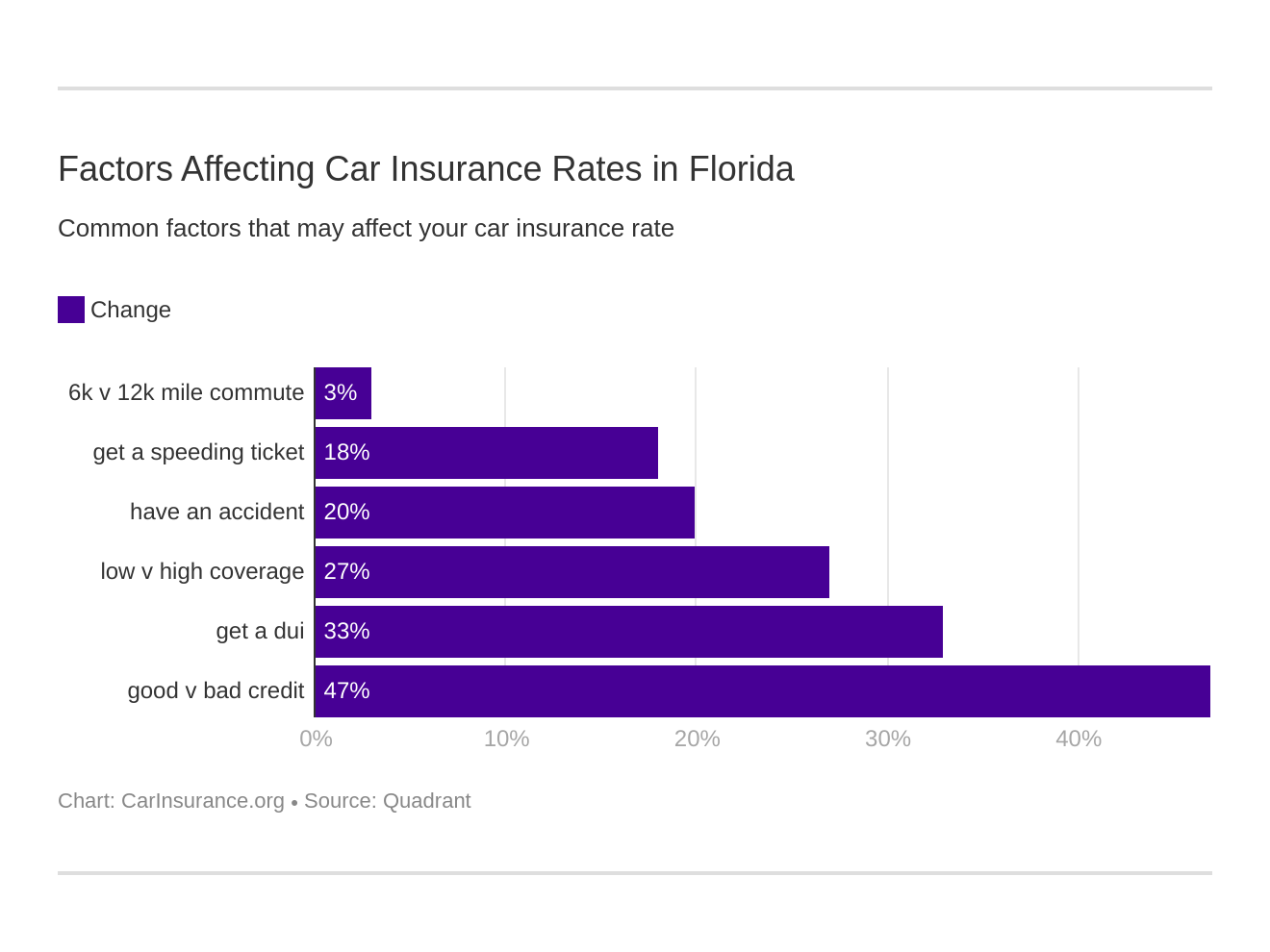

We examined for chauffeurs of several ages with differing driving histories, consisting of chauffeurs with citations for driving drunk and also accidents within the last three years. We additionally examined for vehicle drivers who had different credit report as well as those who lease and also those who possess their residences. We put through discounts provided by over a lots auto insurer in Florida.

Several cars and truck insurance policy firms provide discount rates, however they typically deal with vehicle drivers that have superb credit history as well as ideal driving backgrounds. By finding firms with a more varied food selection of discount rates, we're able to aid a variety of various chauffeurs locate the most effective automobile insurance in Florida. We compared several online markets for automobile insurance to find the most thorough one.

All about The Best Car Insurance In Florida For 2022 - Investopedia

1 selection as one of the most advisable cars and truck insurance provider in Florida for the huge majority of motorist accounts that our research study team checked. What You Need to Know Concerning Florida Coverages Florida auto insurance policy regulations are one-of-a-kind because Florida is a no-fault state. Be sure to comprehend what this indicates (see below for more details), and also consider bring insurance coverage above the state minimums for more defense (cars).

Put in the time to access the very least 5 cars and truck insurance prices estimate from business in Florida prior to choosing which one is best for you. Make certain to ask regarding discounts you certify for as well as whether the insurer will elevate your rates after you have actually been with them for even more than a year.

Examine out the sections below to find out which firms supply the most inexpensive rates for vehicle drivers like you. The Cheapest Fees for Teen Motorist in Florida Searching for budget-friendly auto insurance for adolescent drivers in Florida is easier than you could assume. Unlike some states, numerous vehicle insurance providers want to gamble on young vehicle drivers.

: Excellent Trainee Discount Rate. To gain this price cut, many auto insurers need the teenager driver to maintain an ordinary quality of B or higher.

This program encourages safe driving routines by monitoring your actions behind the wheel by means of an app that's installed in your lorry. The app elements in the amount of miles you drive and the hrs you get on the roadway. It additionally considers your driving design, such as hard and also constant stopping and driving at broadband.

Little Known Facts About Male Vs. Female Car Insurance Rates In Florida.

Some courses can be taken on the internet as well as will consist of interactive lessons with 3D animation as well as video. Most Inexpensive Quotes for Florida's Youthful Drivers When drivers turn 25, they can anticipate to see a sharp decrease in their auto insurance costs. Young chauffeurs in between the ages of 18 24 will certainly still pay higher than typical rates for automobile insurance.

If you compare the prices for young drivers with teenager vehicle drivers, you see a decline in regular monthly rates - auto insurance. The most economical price for young drivers ($127/mo) is over $45 more affordable than it is for teenager chauffeurs ($173/mo). You see this trend reflected in all the ordinary month-to-month prices for young vehicle drivers.

The most pricey insurance firm on the listing is $14 away from $300 a month! Yet your look for the most affordable car insurance in Florida can be simply a few quotes away (insurance company). Search to locate the ideal options based on your certain insurance coverage needs. Make sure to request all offered discounts and also contrast apples to apples when considering your vehicle insurance coverage cost.

While prices often raise slightly as you hit 65+ it doesn't imply you need to opt for expensive prices - credit. This is very important because as soon as you're no more functioning you need to conserve where you can. Take a look at 4 of the most inexpensive car insurance policy premiums for retired drivers in Florida.

Our listing also includes Esurance ($132/mo) and also Liberty Mutual ($180/mo.). low cost auto. While the rates we've given are affordable, there might be added cost savings to be had. Take some time to search for additional insurance coverage estimates. With a distinction of $80/mo between insurers, it's not a surprise that senior citizens are seeking means to save money.

Excitement About Why Are Florida Auto Insurance Rates High? - Insurancequotes

Finding the least expensive car insurance policy in Florida may be a lot easier than you believe. The Best Prices for Married Drivers in Florida Being a married vehicle driver in Florida will generally get you more affordable vehicle insurance policy.

Contrasted with wedded vehicle drivers, single chauffeurs are paying much more typically for cars and truck insurance policy. While the cheapest alternative for wedded chauffeurs is $81/mo, the most affordable insurance company for single vehicle drivers sees them paying a month-to-month costs of $91/mo. While a $10 distinction may appear small, it's still worth going shopping around to see if you can discover more affordable rates.

Females Remarkably, male drivers can anticipate to dish out a little much less than women in Florida when paying car insurance coverage costs. Although guys are typically deemed a greater risk team than ladies, we discovered guys have reduced premiums at all yet among the 5 most budget friendly automobile insurance firms listed here.

Dairyland, Guarantee America, Infinity, and Straight Vehicle were one of the most budget friendly for both genders - suvs. Gainsco was the single insurance company offering somewhat cheaper prices for ladies ($119/mo) than men ($129/mo). The Most Budget-friendly Rates for Floridians with Spotty Driving Records Having one ticket on your document might seem like the start of greater costs, yet it doesn't have to hold true.